On June 11, the U.S. Senate passed a five-year Farm Bill that includes a rural energy savings program administered by the U.S. Dept. of Agriculture. Photo courtesy of Tim Coolong

On June 11, the U.S. Senate passed a five-year Farm Bill that includes a small provision with significant potential for reducing energy costs for rural Americans.

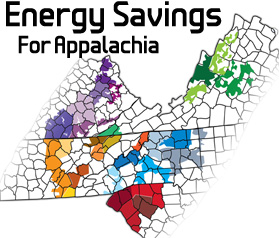

The Rural Energy Savings Program (RESP) — based on South Carolina’s successful “Help My House” program and first introduced in 2012 as a stand-alone bill — would authorize the U.S. Department of Agriculture’s Rural Utilities Service (RUS) to provide zero-interest loans to rural electric cooperatives to create what is known as “on-bill financing” programs. Should RESP be passed as part of the final Farm Bill, Appalachian Voices will work hard to promote the program to rural residents and electric coops through our Energy Savings for Appalachia program.

With on-bill financing, electric coops offer low-interest loans to their residential customers to finance energy efficiency improvements to their home, and the residents repay the loan through an extra charge on their electricity bill. In rural America, which largely gets its electricity from electric membership cooperatives, there is a greater concentration of inefficient housing and low-income residents. Low-interest loans that save homeowners and renters a significant amount of money on their electricity bills could have a significant financial impact not only for the residents and the local economy, but also for the electric cooperatives.

On-bill financing programs supporting home energy efficiency improvements are relatively new, but they have already proven to be highly successful and growing in popularity, particularly among heavily rural, conservative states. For instance, pilot programs having been implemented in Kentucky and South Carolina, and a full-scale program is being offered through Midwest Energy in Kansas. Each of these programs has achieved an average savings of 20 percent or more for their participating customers, and initial results for the South Carolina program estimate that the average loan is saving participating low-income residents nearly $1,300 per year.

(more…)

Read More ...